The spring housing market in Santa Cruz County is heating up faster than a beach bonfire at Sunny Cove! Despite rising mortgage rates, our local market is seeing a surge of new listings meet eager buyers. Let's break down the latest stats and what they mean for you as a buyer or seller.

April Rundown

The Santa Cruz County housing market is experiencing an exuberant spring. Despite interest rates inching up from 6.79% at the end of March to 7.1% for a 30-year fixed mortgage, the real estate momentum shows no signs of slowing down. Sellers are seizing the opportunity, with a massive influx of 223 new listings hitting the market in April - an 18% increase month-over-month and a 22% year-over-year surge.

This rise in supply has been warmly welcomed by eager buyers, resulting in 122 closed sales, reflecting a 27% monthly uptick and a remarkable 38% year-over-year boost. The driving forces behind this frenzy are multifaceted, ranging from growing families seeking more space to empty nesters chasing their next adventure, and perhaps even a spillover effect from the Silicon Valley boom.

Market Indicators

- Median Sales Price: $1,410,000 (up from $1,315,000 in March)

- Average Days on Market: 32 days (3 days faster than March)

- Price Reductions: Only 15% of homes sold in April reduced their price (compared to 25% in March and 22% in April 2022)

While higher interest rates did contribute to a slowdown in pending sales towards the end of April, consumer sentiment remains optimistic. Buyers are adapting to the new post-pandemic normal, recognizing that life events necessitate action, regardless of market fluctuations. Sellers, too, are capitalizing on this momentum, with rising prices and a brisk pace of sales.

Should I Wait for Mortgage Rates to Decline?

The Rate-Demand Relationship

If you've been contemplating a move, you may be wondering whether it's wise to wait until mortgage rates decline before taking action. In the housing market, there's a longstanding relationship between mortgage rates and buyer demand. Typically, higher rates correlate with lower buyer demand, as some individuals hesitate to take on a higher mortgage rate for their next home, prompting them to postpone plans and wait out the market.

The Demand Resurgence

However, when rates start to decrease, the dynamic shifts from limited demand to robust, strong demand. A significant portion of buyers who stayed on the sidelines during higher rate periods will re-enter the market to pursue homeownership goals. As Lisa Sturtevant, Chief Economist for Bright MLS, explains: "The higher rates we're seeing now are likely going to lead more prospective buyers to sit out the market and wait for rates to come down."

Adapting to the New Rate Environment

Data shows more homeowners are adapting to the current rate environment and reconsidering their decision to move. Mark Zandi, Chief Economist at Moody's Analytics, notes "Listings are up a bit as life events and job changes are putting increasing pressure on locked-in homeowners to sell their homes. Homeowners may also be slowly realizing mortgage rates aren't going back anywhere near the rate on their existing mortgage."

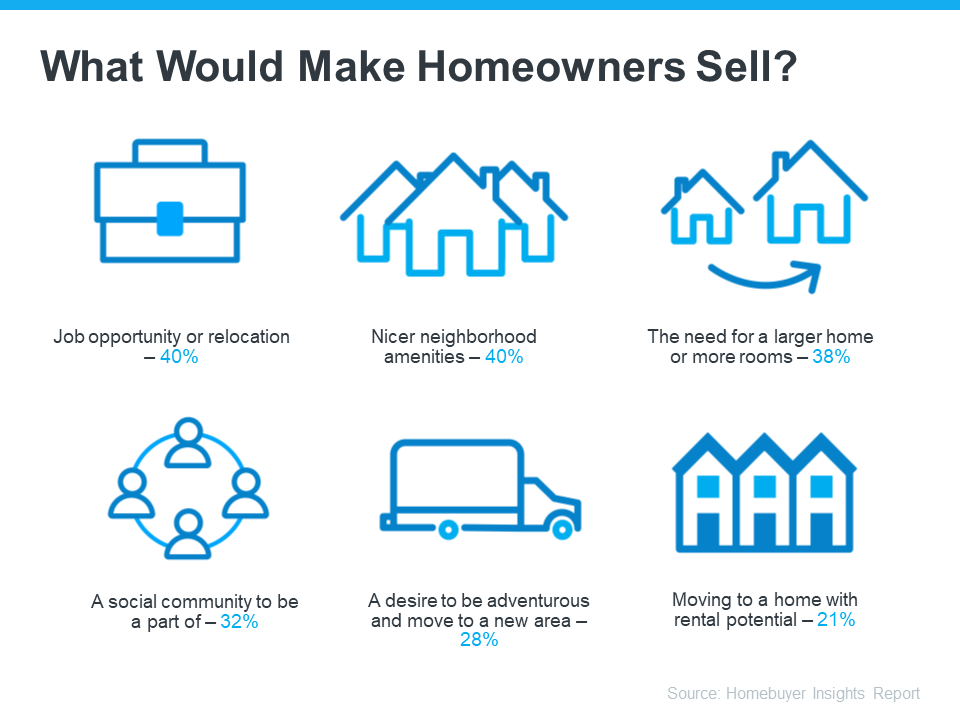

A recent Bank of America study shed light on factors motivating homeowners to sell even with today's rates, such as:

The Timing Considerations

According to experts, mortgage rates are still projected to decline this year, albeit later than initially anticipated. When rates drop, more people will re-enter the market, resulting in increased competition from other buyers when purchasing your next home. This heightened demand could make your move more stressful due to more multiple-offer scenarios and faster-rising prices.

However, if you're ready and able to buy or sell now, it may be worth capitalizing on the opportunity before competition intensifies. As you weigh your options, consider current rates, their projected trajectory, and what would prompt you to make a change. An experienced real estate professional can provide guidance tailored to your priorities.

When deciding whether to wait for rates to decline before moving, don't forget to factor in the potential buyer demand surge once rates decrease. If you want to get ahead of intensified competition and sell now, let's discuss your specific situation and strategy. Other homeowners are adapting and deciding to move - is it time for you to re-enter the market as well?

What More Listings Mean When You Sell Your House

The Key to Standing Out With Rising Inventory

In today's Santa Cruz County housing market, the number of homes for sale is playing a pivotal role. For sellers considering listing their homes, the current limited supply presents a significant advantage – your property stands out more when inventory is low, especially if priced strategically.

However, the supply of homes for sale is growing. According to data from the local MLS Listings, new listings (homeowners who have just put their houses up for sale) are trending upwards. March saw a 22% year-over-year increase in newly listed homes, marking the third consecutive month of rising listing activity after 2023 having the lowest annual inventory in decades.

Striking While the Iron is Hot

If you've been postponing the sale of your home, now might be the ideal time to reconsider – before your neighbors do. While a surplus of homes for sale is unlikely, each new listing in your area carries the risk of diverting buyer attention away from your property. This is especially true if a neighbor lists their home, creating direct competition right next door. You don't want potential buyers to tour your home only to fall in love with someone else's listing. Your goal is to keep your property in the spotlight.

Seizing The Opportunity

A skilled real estate agent can be instrumental in ensuring your home remains the focal point for buyers. They will help you prepare your property for listing, highlight the features that today's buyers are seeking, and guide you in pricing it competitively. This approach will not only draw buyers to your listing but also increase the likelihood of them being eager to make it their home.

If you're ready and able to sell now, you have the opportunity to capitalize on the best of both worlds. As the supply of homes for sale grows, you'll have more options for your own move. Simultaneously, you'll be able to sell while your home still stands out amidst less competition.