Is the economy getting back to some sense of normalcy? It's the question everyone wants to be answered as we navigate through a semi-return to sanity entering the third year of the pandemic.

The COVID-19 pandemic disrupted the home-buying process in ways none of us expected. Historically-low mortgage interest rates combined with an inventory shortage relative to buyer demand created the perfect storm for a red hot market, with homes selling within hours, often mind-bogglingly over the asking price.

Nobody has a crystal ball for exactly what 2022 has in store for housing in Santa Cruz County. But industry experts all predict that in 2022 buyers and sellers can expect similar trends to what we saw over the last two years: elevated prices, low inventory, and a fast-moving market. In 2021 homes in the county sold in an average of 24 days for an average of 4% above the asking price.

Although it will still be a strong seller's market it isn’t likely to be quite as crazy as it was in 2021. I can’t promise that finding a home will be easy, but it feels reasonable to think that it will be easier than this past year.

With that in mind, here are some things to know about the real estate market in 2022.

Low Inventory Will Persist

Before the pandemic set in, there was low housing stock in Santa Cruz County and all across the country. COVID-19 supply chain disruptions and a labor shortage made things worse.

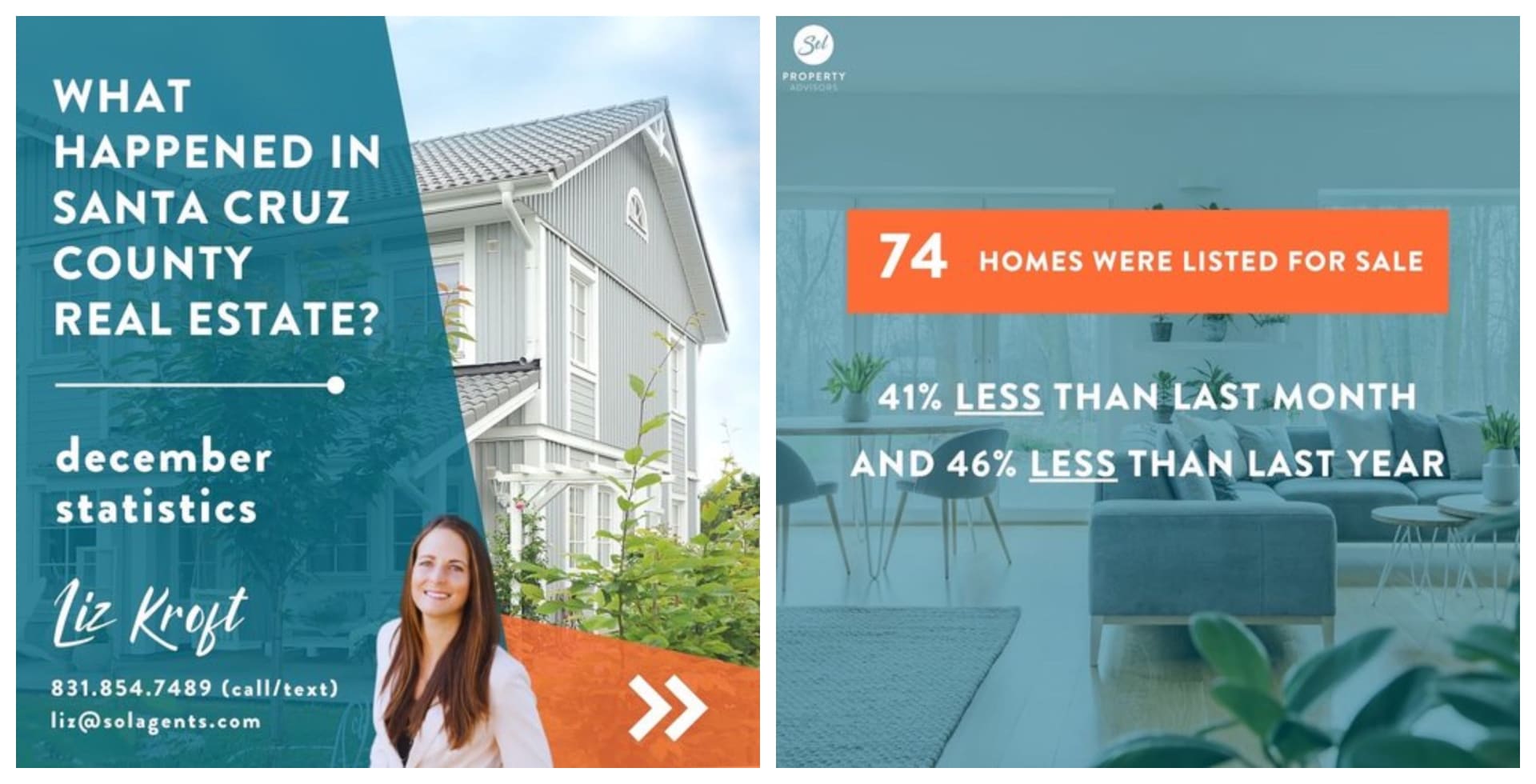

In fact, the number of homes listed for sale in December hit the lowest point in two years, with only 72 single-family homes coming to the market on the MLS. In the first week of January, we only have 0.68 months of inventory. This is the lowest I have ever seen.

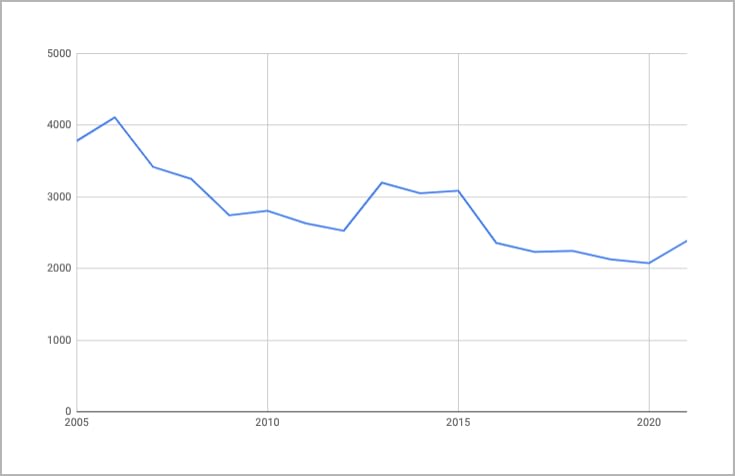

Now oddly enough, the total number of homes listed for sale in 2021 was the highest the market had seen since 2015. So it is not necessarily that no homes are for sale, it is supply relative to the exceptional level of buyer demand in the market.

Annual single-family inventory totals in Santa Cruz County.

Inventory rose in 2021 and will likely rise again in 2022, but the housing shortage will still be a defining characteristic of the market once again.

Interest Rates Will Continue To Increase

The Federal Reserve is expected to raise interest rates a few times this year, which means mortgage rates are expected to rise. The general consensus among industry experts is that the 30-year-fixed mortgage rate will reach 3.6% by the end of 2022. Compared to an average of 3.3% now.

This rise in rates is not necessarily terrible news for buyers. The “silver lining” of higher rates is that fewer speculative buyers will be in the market because there is less money to be made. That could help the average buyer by lessening competition to some degree.

When you have higher rates, it becomes more of the people who buy primary residences, something the market could benefit from.

Prices Won’t Decrease

Economic trends including limited supply, high demand, and low mortgage rates will continue to give sellers the advantage in the market. Buyers can continue to expect bidding wars on many homes, particularly in the peak season in the spring and summer.

What some housing analysts believe, however, is that home-price growth will slow significantly in 2022. Numerous forecasts suggest that prices nationwide will rise by around 5% in 2022, compared to the double-digit gains of 2021. In December, the Santa Cruz County median sales price for a single-family home was $1,212,952 - an 11% increase from December of 2020.

Not everyone shares this view of price growth. Some believe that home prices will keep rising by double digits - or at least for the first part of it.

So what are four factors boosting values?

-

Low mortgage rates.

-

Loosened mortgage standards.

-

An ongoing inventory shortage.

-

The work-from-home trend.

Affordability has been a real challenge these last two years with low mortgage rates and soaring buyer demand providing some balance. But today, with rates rising as we come out of the pandemic, fears concerning inflation are surfacing.

Young Homebuyers Will Be At A Disadvantage

Millennials, who are in their prime age as first-time homebuyers, will remain at a disadvantage compared to older generations when it comes to purchasing a home. This is because Boomers are staying in their homes longer as they live longer and because homes are so much more expensive now than they were when baby boomers and older generations were buying their first homes.

As a result, more first-time homebuyers are likely to seek financial support from family and friends to make a down payment.

Housing affordability in Santa Cruz County has been an issue for buyers, particularly young ones, for some time. But the issue has only been exacerbated since the onset of the pandemic and will continue. Unfortunately, we have made the list of least affordable places to live for a number of years now.

Homebuyers Should Be Prepared

With all of that said, my best advice for buyers is to be prepared. Connect with a lender now to get pre-approved for a loan and do your research ahead of time so you’re ready to go when you find the perfect home.

When looking for a home in the next year it will be important to keep a close eye on the market and work with a highly experienced Realtor who can help you compete and knows where to find off-market opportunities with less competition.

While you will have to act fast, make sure your interests are protected and you don’t overpay. Price will be high, but that doesn’t mean you should purchase something too far outside your budget.

Sellers Still Have An Unbelievable Advantage

With mortgage rates climbing, serious buyers are more motivated than ever to find a home. Housing demand will remain strong as buyers seek to secure a home before mortgage rates increase by the end of the year and into 2023.

With buyers eager to purchase the limited homes available, sellers who list their homes this year have a tremendous advantage - also known as leverage - when negotiating with buyers. That’s because, in today’s market, buyers want three things:

-

To be the winning offer on their dream home.

-

To purchase before rates rise.

-

To purchase before home prices soar even higher.

This leverage can help you negotiate your best terms. The world is truly your oyster as a seller in today’s market. These three buyer wants to give homeowners a leg up when selling. You might already realize this leverage enables you to sell at a good price, but it also means you can negotiate the best terms to suit your needs.

Speaking of price, it is important to remember that it is still never a good idea to overprice your home. The best strategy is to price your home at what is reasonable based on recent sales and let the market take it from there.

Since buyer demand is still so exceptional, there’s a good chance seller will receive multiple offers. When they do, look closely at the terms of each offer to determine which one has the best terms for you. It is important to note that a strong offer is determined by more than just the price.

Bottom Line

Today’s buyers are motivated to purchase a home this year, and that’s great news if you’re thinking of selling. Buyers shouldn’t lose hope. Interest rates, while on the rise, are still low and there will be great opportunities this year if you are properly prepared and working with a top real estate advisor.

Whatever your real estate goals, let’s connect today to discuss the best strategy for you. It is never too early to start planning and preparing for the future.